However, economic conditions are improving dramatically in the U.S. and across the globe, according to the National Retail Federation (NRF). The NRF expects national retail sales to grow between 6.5–8.2%, reaching more than $4.33 trillion in 2021.

This forecast aligns with the revenue growth that Acceleration Partners’ clients have already seen in Q1 of 2021. This past quarter included a 21% revenue growth year-over-year (YoY), but a 86% decrease in clicks as consumers are converting and not just browsing like they were in 2020.

The global pandemic accelerated shopping behaviors as consumers shifted to digital and mobile commerce more than ever before. According to the recent Adobe Digital Economy Index, January to February 2021 alone saw consumers spend $121 billion online, which was a 34% increase from last year.

Other factors contributing to the increase included a rise in payment methods such as “buy now, pay later,” home improvement products growing 60% YoY, apparel growing 22% YoY and consumers continuing to leverage BOPIS (buy online, pick up in-store).

While some industry analysts expect U.S. retail sales to jump in March and April, thanks to the mid-March stimulus checks, others are expecting consumers to save their stimulus checks and tax refunds this year for when they feel comfortable spending again once the vaccines are more widely rolled-out.

In the UK, economists are expecting retail sales to turn positive for the first time since December 2019. This prediction is based on the growth seen since April 2020, which is when the historic drop occurred. Economists are hopeful for an increase in commerce as we look ahead into Q2 and beyond.

Acceleration Partners’ clients experienced double-digit increases in revenue and orders YoY with slight decreases in Average Order Value (AOV) and new customer orders. While clicks were down 86% YoY and AOV was down slightly at 5% YoY, conversion rates increased by 2% YoY.

At the start of the global pandemic in March 2020, we started to see decreases in conversion rates within our clients’ programs, yet consumers were clicking on affiliate links. This year, we’re seeing consumers converting more; consumer confidence has also increased globally.

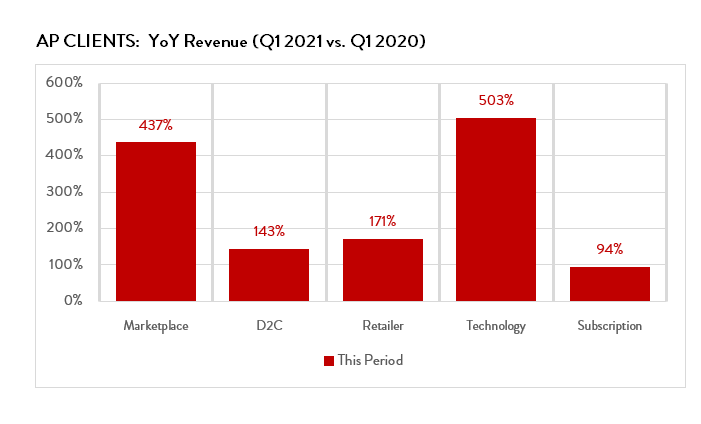

Comparing our clients’ data between Q1 2020 and Q1 2021, we saw double- and triple-digit increases in revenue across all business models.

Overall, the Q1 2021 “wins” for Acceleration Partners’ clients globally included: new customer acquisition campaigns, strong promotions, increased rewards with loyalty partners and content-focused placements.

We saw increases across the board for all business models, including:

*This data is based on revenue only and does not include other “actions” such as lead-based programs.

**This data does not include Streamline Marketing clients.

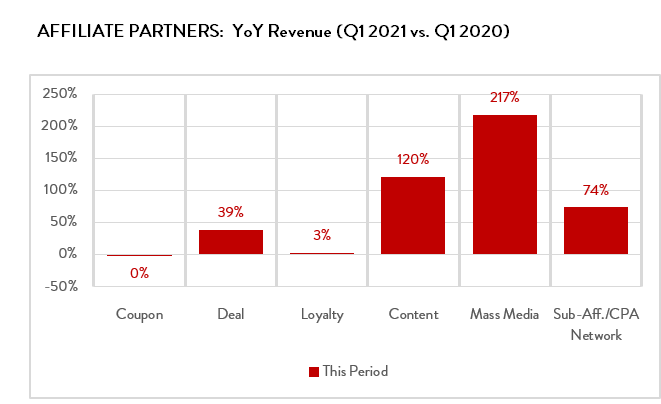

Revenue from all affiliate partner types were up YoY, with the exception of revenue from coupon partners, which were down slightly (less than 1%), driven by a 13% decline in clicks and a 46% decline in commissions.

We will continue to share our client data quarterly for the rest of 2021. Look for the next report on Q2 to be shared in July.

Questions about this data or the strategies other brands are finding successful? Contact our team!