Acceleration Partners Clients’ Revenue Grows +6% YoY Over 5 Days of Cyber Sales

The holiday shopping season, as expected, started much earlier this year. According to Adobe, there was a slight decline (down 1.4%) in revenue over five days of cyber holiday sales, from Thanksgiving to Cyber Monday, with Thanksgiving day the only day up in revenue at 0.5% over last year. As brands kicked off cyber week messaging and promotions in early October, consumers started shopping much earlier this year, resulting in U.S. online retail sales increasing 8% in October 2021 vs. October 2020.

According to Adobe Analytics, consumers were eager to spend from November 1st through Cyber Monday, with online sales totaling $109.8 billion, up 11.9% YoY, and on 22 of those days, consumers purchased an astonishing $3 billion worth of goods. With the global supply chain issues, out-of-stock messages surged, with more than 2 billion out-of-stock messages seen online (up significantly 325% compared to the same month in 2019).

Affiliate Marketing Solidified as a Strong Performer

For Acceleration Partners, we saw an increase of 6% in revenue year-over-year (YoY) from our clients globally, specifically seeing strong increases from our apparel, entertainment, food and beverage, technology and travel brands. We saw revenue declines in business solutions, education and household, but did see a 7% increase in new customer orders for household brands.

With the combination of the supply chain disruption and inflation, the average selling price over cyber weekend was up by 11% compared to last year. Additionally, the average discount was down by 26% according to Salesforce, which led to higher shopping cart totals but less transactions.

AP’s Client Performance Data: Cyber Holidays 2021 vs 2020

(11/25/21–11/29/21 over 11/26/20–11/30/20)

Acceleration Partners saw a similar trend with a 2% decline in overall orders but a 13% increase in AOV. The conversion rate for the global combined programs also declined by 13% as consumers were looking for deals and discounts that may not have been available like years before. However, new customer orders and new customer revenue was up 123% and 93% respectively, as consumers leveraged affiliate partners to find the perfect holiday gift.

Additionally, with more consumers browsing to find in-stock items, our clients paid for the conversion and not the traffic (clicks), which continues to reiterate why affiliate marketing is one of the most profitable channels.

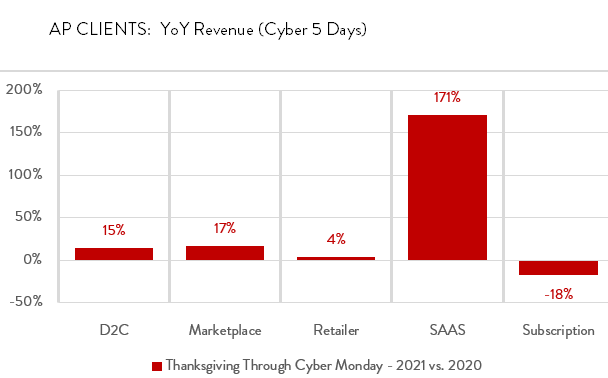

Marketplace clients were up 17% in revenue overall, followed by direct-to-consumer (D2C) clients up 15%, while subscription brands were down 18%. Contrarily, D2C clients saw a 16% increase in orders aligning with the increase in prices and higher shopping cart sizes, while marketplace clients saw a 16% decline in orders as prices remained competitive despite inflation and supply chain concerns. With this change, marketplace clients saw a 32% decline in new customer orders, while D2C clients saw a 32% increase in new customer orders.

*This data is based on revenue only and does not include actions such as lead-based programs.

Affiliate Partners’ Performance Data: Cyber Holidays 2021 vs 2020

(11/25/21–11/29/21 over 11/26/20–11/30/20)

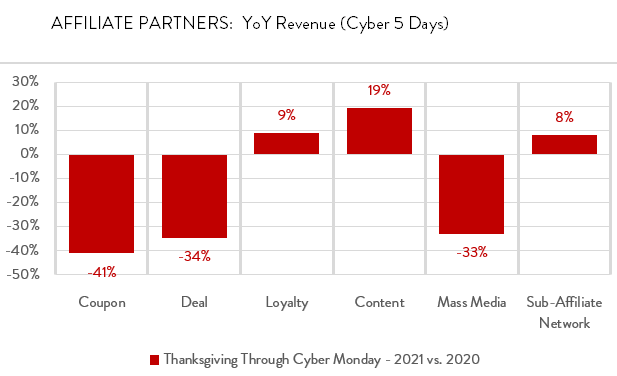

For affiliate partner types, loyalty partners were up 9% in revenue as brands leveraged rewards or cash back increases as a promotion, and content partners saw a 19% increase in revenue with more consumers researching specific products from trusted sources. Coupon and deal partners were down 41% and 34%, with some promotional messaging limited compared to last year.

Up Next … Quarterly Client Data

We will continue to share our client data quarterly for the rest of 2021. Look for the next report on Q4 to be shared in January 2022.

Questions about this data or the strategies other brands are finding successful? Contact our team!