Q3 2021 Benchmark Report of Global Affiliate Programs

The summer quickly approached and as expected, with many consumers eager to travel and venture back to restaurants and experiences. According to the U.S. Department of Commerce, retail sales in July rose 11.5% over the last year and 23.2% from 2019. By August, however, U.S. consumers were heavily impacted by the Delta variant, inflation and supply chain disruptions, leading to a 13.4% drop in spending from July.

Back to school was also a major focus at the end of Q3, and initial results are showing 77% of back to school shoppers in the U.S. purchased online and 37% of back to school shoppers purchased more online this season than in 2020. Additionally, 58% of shoppers were influenced by a child to purchase a particular item as consumers continue to become more comfortable shopping online, compared to shopping in-store.

High-Level Overview of the Global Consumer Landscape in Q3 2021

For Acceleration Partners, we saw a 12% increase in revenue year-over-year (YoY) from our clients. The strongest increases in revenue came from entertainment, food and beverage, household, technology and travel verticals. We also saw a slight decrease (down 3% in revenue) in apparel, but saw a 108% increase in new customer orders for apparel.

Globally, eMarketer is projecting worldwide e-commerce sales will continue to increase, making up 24.5% share of all retail sales by 2025 and in 2022, China’s retail e-commerce sales will surpass 50% of total retail sales in the country. Our clients are seeing increases globally in new customer revenue and orders with travel up 146% in new customer revenue and household up 52% in new customer revenue YoY.

Acceleration Partners’ Client Performance Data: Q3 2021 (July – September)

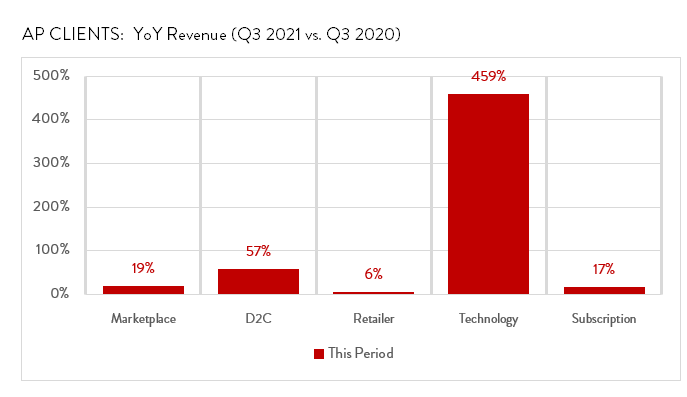

Looking at our client data between Q3 2021 and Q3 2020, we saw increases in revenue and Average Order Value (up 10% YoY), but did see decreases in clicks (down 66% YoY) as consumers shifted their behaviors in-store to interact with the product.

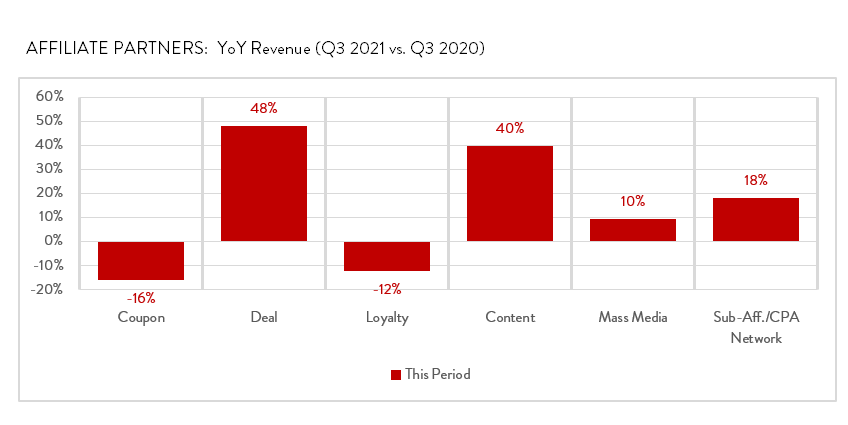

While traffic was down, we continued to see consumers engaging with content partners (up 40% in revenue YoY) and mass media partners (up 10% YoY) influencing their purchase decision.

Acceleration Partners’ clients experienced several global successes in Q3 2021, including onboarding “buy now, pay later” partners, content exposure and pushing deals earlier for back-to-school season.

Across all business models, some of the more notable changes we saw included:

- Significant revenue increases in health and wellness, technology and travel. This is aligned with consumers shopping earlier for the holidays to get ahead of supply chain disruptions.

- Increase in Direct-to-Consumer (DTC) clicks at 6% YoY, while retailers saw a slight decline at 13% YoY. This is driven by consumers shifting to shop directly with brands, if given the option.

*This data is based on revenue only and does not include actions such as lead-based programs.

Affiliate Partners’ Performance Data: Q3 2021 (July – September)

For affiliate partner types, all partners were up in revenue, with the exception of coupon and loyalty partners, which were down 16% and 12% respectively YoY.

Up Next: Q4 Benchmark Report

We will continue to share our client data quarterly. Look for the next report on Q4 to be shared in January 2022.